[By Craig L. Blomberg, 2015]

Editor’s Note

On September 24, 2014, the HBU Center for Christianity in Business hosted a conversation with Ron Blue, who was interviewed by Houston Baptist University trustee and attorney Joe Sleeth, on kingdom stewardship. The CBR is pleased to provide an edited excerpt of this conversation for the benefit of our readers.

Sleeth: What is “kingdom stewardship” really about?

Blue: When my wife and I finished touring the spectacular Bible Museum here on HBU campus this morning, my wife said, “if it is new it is not true. If it is true it is not new.” That’s so right about biblical principles. Once I testified before a Congressional subcommittee in the early 1990s about personal finance. Senator Chris Dodd of Connecticut asked me what I would tell the American family. I thought he was going to laugh because what I was about to say is so simple. I said, senator, I will tell the American people to spend less than what they earn; avoid the use of debt; build liquidity, margin or flexibility into their financial plan; and set long term goals so they can prioritize spending between the short and long term. As the Senator busily jotted down my remarks, he commented, “it seems to me that would work at any income level.” To that I replied, “you’re right senator, including the United States government!”

What I failed to mention was there actually is a fifth principle: to give generously. Together these are the five fundamental biblical principles that would never change. I am 72 years old. I am in my sixth career, and I need to hurry. A couple of years ago I had a very unexpected bypass surgery that gave me a lot of time to reflect on things. I believe God has given me the opportunity to trumpet the truth that God’s word is authoritative for every financial decision anybody wants to make at any time. He gives us wisdom for the process (James 1:5). He treats each one of us uniquely in that we are not lost in rules but should live by principles that are transcendent.

When we make financial decisions that are based on transcendent principles, we can be very confident of the results as they are built on solid rock (Matthew 7:24). My organization is developing curricula for Christian colleges, churches, and marketplace professionals that carry that same message. We have an opportunity to introduce a biblical worldview on money and money management that has a common language and process to impact our culture evangelistically. Everybody thinks about money and worries about it. We as believers can say, look, here are five key principles. That’s all you really need to know. Only five things you can do with your money: give it away, pay taxes, pay off debt, save it, or spend it on your lifestyle. God’s word speak to all of them.

Kingdom stewardship when it comes to financial matters is to be empowered with a biblical worldview on money and money management. My desire is to help facilitate that process of empowerment. I think most believers know what God’s word says. They just don’t necessarily know how to make it work on an ongoing basis. That’s where I like to help.

Sleeth: In 1 Timothy 6:17, Paul writes: “Instruct those who are rich in this present world not to be conceited or to fix their hope on the uncertainty of riches, but on God, who richly supplies us with all things to enjoy.” In this society where excesses appear to be the norm, how do Christians understand and practice a life of contentment that Paul talks about?

Blue: Part of it is found right there in that passage: “to be generous and ready to share” (v. 18). I wrote a book called Generous Living. I wrote it because I know giving breaks the power of money. Either money holds us or we hold it with our palms open – to give it away. Giving makes no economic sense whatsoever. You get a tax deduction, perhaps. But you can take a deduction on a loan to me that I promise never to repay. Is that smart?

My clients generally share three distinct characteristics. They are content, confident, and able to communicate well about money. The reason is they all have an eternal perspective – they manage money with eternity in view. Jesus reminds us in the Sermon on the Mount that if we send our treasure on ahead then we don’t have to worry about anything. Most of us kind of bound up with more is better. The reality is “more” causes more choices and confusion. My wife and I started out in a trailer that’s 28 feet long, 8 feet wide and 6 feet tall. You can sit on a stool and do dinner, cook and do the ironing. We didn’t have many choices then. Fifty years later we got a lot more choices and life is much more complex. Giving with the eternity perspective simplifies life’s choices and is the only way to break the power of money.

Sleeth: A common question that faces finance professionals and business people is how much is enough. I got a lot of questions about people not wanting to leave all that money to their children; people who don’t want to be trust babies. What are the guidelines?

Blue: I spent many years helping people define their finish lines: how much is enough – to give to the kids, to accumulate, to retire on, etc. Just a few years ago I found the answer to it – Hebrew 13:5: “…being content with what you have.” We will never be content with something we don’t have. Contentment is a mindset, it is a paradigm and a belief system. It has nothing to do with money. If I really believe God says He will supply all my needs, can I say I don’t know what I need until I get to the mall? If it is true that God will meet all our needs and even promise us eternity, should I not trust him to define my needs? If so then my behavior follows my belief system.

Sleeth: So why do Christians need to plan? Can we just sit back and trust that God is going to provide and meet our needs?

Blue: I was to go through a heart catheterization procedure when I went to the hospital two years ago. I thought I was to be home that afternoon. The doctor worked on me for a few minutes and immediately went to tell my wife that they don’t generally see my kind of conditions except in autopsies. I found out that I might not have lived through that weekend without surgery. Was I going to trust God and not do the heart surgery? God doesn’t work that way with us. Think about the plans David made for the temple. Jesus had purpose and plans but he was always moving as the Holy Spirit leads. Failing to plan is poor stewardship. It doesn’t mean you are committed to the plan, just the process. Part of the process for good stewardship is thinking ahead and planning. To me for a Christian to say I am just trusting God is nothing but foolishness.

GIVING BREAKS THE POWER OF MONEY.

Sleeth: Beyond the financials, what else is within the scope of stewardship?

Blue: When you mention stewardship people generally think of one of two things: tithing, or money. The reality is stewardship covers our entire life. I am a steward of everything I received – over my health, my tongue, my family, time that I am given, truth that I know, relationships that I enter, and everything else. Money is just one, literally, small piece, of stewardship. It is merely a tool that we use to do all these other things to accomplish God’s plan and purposes.

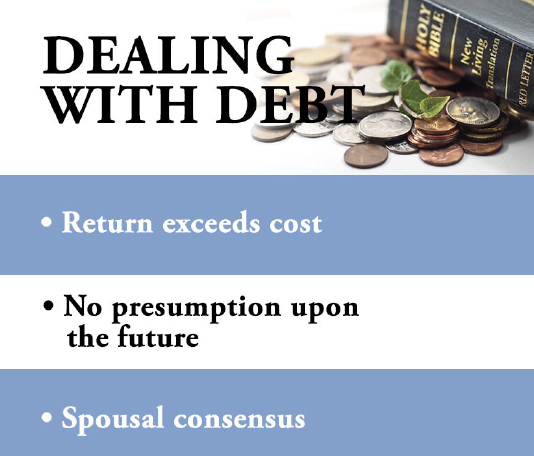

Sleeth: Where does debt fit into the whole financial picture?

Blue: We have an economy bolted on debt. Debt needs to be repaid by somebody at some point and is better avoided. We need to be clear that borrowing money is not a sin; nowhere in the Bible says otherwise. The Scripture does say not repaying what is owed is a sin. Borrowing money is not the issue. Credit cards do not get people into trouble; the one who holds the cards does.

There are generally five kinds of debt: mortgage, credit card, consumer, business, and student debt. I often counsel people regarding the rules they need to follow when borrowing money. One is the economic return needs to exceed the economic cost. To borrow money at 18% interest so you can go out to dinner doesn’t make a lot of economic sense. But borrowing for a college education probably does (as evidence proves a college education pays off ). Mortgages? It depends. It generally makes sense unless you presume upon the economy.

Second, Scripture says don’t presume upon the future. To borrow is to make an assumption about the future – that you are able to repay the debt. The question to ask is what is the repayment plan? Are you presuming on a bonus, on salary raises, on an inheritance, or anything else that may or may not occur?

Third, there needs to be spousal unity when it comes to incurring debt. I am an entrepreneur and started six businesses. When I started my last one my wife said does that mean we are not getting paid again? One of my mentors is Dr. Howard Hendricks and he used to say God does not give you a spouse to frustrate you but to complete you. What I found in counseling with thousands of people is when you put two people with diff erent training, experience, and value systems into one checkbook you bound to have conflicts. I have seen so many husbands benefited from their wives’ counsel and many have not taken their wives’ counsel. Once I was speaking to a group of professional athletes. There was one guy sitting at the back with three Super Bowl rings. When I made that comment about the wife’s counsel his wife started weeping. This fellow had all the money and he went into some business that his wife counseled against. He didn’t listen to her and they lost everything.

The bottom line is this: if you can help it, it is better not to be in debt at all. What about mortgage debt? I am often asked. If you say to a CPA that you want to reduce your taxes one of the things he is likely to recommend is to increase your mortgage because you get to deduct the interest. But this is like saying give me $10,000 and I promise never to repay you, so I will report the income and you get the tax deduction. The right question is not how I can reduce taxes, but how I can increase my cash flow after taxes. So don’t assume that mortgage debt always makes sense. I haven’t had mortgage debt in a long time and I feel pretty good.

Sleeth: Financial advisors will say don’t pay off the mortgage. You can invest the money and make a greater return on the savings. What do you say to that?

Blue: Let’s assume the mortgage rate is 3%. Ask the financial advisor if he can guarantee a 3%+ return for the next 20-30 years? When you stop the mortgage and save that interest, it is the same as making an investment yielding 3%. It is an investment decision. No financial advisor I know will absolutely guarantee you that kind of return for such a long time. We counsel people often on two big areas: giving money generously and paying off that mortgage. Why not liquidate some assets that have risks and pay off that mortgage debt? Biblical wisdom says the borrower becomes the lenders slave. Follow the biblical principle against conventional wisdom and the cultural norm! It always works.

Sleeth: We know many students are inadequately prepared to deal with finances, be it student loans, credit cards, or something else. When I was growing up I never had conversations with my parents about balancing checkbook and finances. What advises would you have for students and their parents and grandparents?

Blue: We need biblically based personal financial curricula out there in colleges and churches, something we are working on. When we talked to LifeWay about such a curriculum, they say it needs to be simple. The reality is it is simple. Students often see it as way more complex than it is because they have all this information coming at them from advertising – there are millions of dollars spent everyday just trying to make us discontent. Those five biblical principles of money management work throughout our life – living within our income, avoiding debt, having liquidity and savings, setting long term goals, and giving generously. Simple principles but they work! God’s word also speaks to all five things you can do with money: Give it away, pay off debt, save it, pay taxes, and spend it on your lifestyle. God’s wisdom never goes wrong. One more thing: For students who plan to get married, make sure the husband and wife have this conversation about money and values because fifty percent of divorces cite money as the reason. It really is not money but the lack of communication.

Sleeth: Is it biblical that a tax professional should advise clients to reduce their taxes?

Blue: The Bible says render unto Caesar what is Caesar’s. Jesus paid the taxes. Here in Texas you only pay up to (the maximum) Federal rate of 39.6%, so if I have an incremental dollar I get to keep 60.4% of it. Why is it not a good thing? If you pay quarterly estimated taxes like I do you should get on your knees and thank God when you make that payment because it represents the income that God has blessed you with. To me taxes are not the problem because they are symptomatic of income, which comes from God. Plan for taxes yes but never figure that they are a bad thing or ever use illegal means to avoid them. Tax planning is good stewardship. Just make sure you are planning to increase your cash flow and not merely to reduce the obligation on something that testifies to God’s benevolence.

Sleeth: We know stewardship and tithing go together. What’s your view on tithing?

Blue: First, tithing is the training wheels of giving. Give according to how God has prospered you (1 Cor. 16:2). A lot of people say tithing is Old Testament, but so is the principle of the borrower becoming the lender’s slave! Should I take this one and forget that one? Jesus didn’t say don’t tithe, nor did Paul. Throughout the Scripture there is the principle of first fruits. I know how much income I will earn, so I just take 10 percent and divide it by 52. That’s what I give every week, automatically. My personal opinion is tithe to your church and give above and beyond that if anywhere else appeals to you. I read a book by Robert Morris (“Church of Blessed Life”) and it changed my giving behavior. Every Sunday morning I will take any money being earned – service income, interest on bank accounts, etc., write them on a 3×5 index card and give it to my wife at breakfast. “Here is the income.” I’ll tell her, “and you write the check.” It literally changed the dynamic in our relationship, and between us and the Lord. Now suddenly my wife who does not have much interest in money sees what’s coming in. She sees it on a regular basis and all of a sudden we are talking about how God has blessed us. I also believe in giving off the balance sheet in addition to the income statement, because giving breaks the power of money. Tithing should be a non-issue for believers.

Sleeth: Talk to us about investing for Christians. What should we invest in? Should we drill down into what that mutual fund is invested in? Do we avoid businesses that do not align with our values?

Blue: There is a genre out there of what is called biblical investing. This class of investing has credibility because they are done biblically and responsibly and they are having equal to or better results than their peers. There is however a variety of opinion about what is biblically responsible. Some would judge a company on what it makes (e.g., abortion or war products), or how its foundation gives money, or what its stands are on same sex marriage, etc. There is just no commonly accepted definition of biblically responsible investing. Sure people can have a conviction about how their money should be put to use. But if you put your money in the bank which lends it out, do you know where the money goes? We are in the world but not of the world, but we do live in the world. I personally don’t get hung up on one correct way of doing things when it comes to investing. The Bible says each man should be fully convinced in his own mind (Romans 14:5). My advice is: develop a conviction, as led by the Holy Spirit, so each person be fully convinced in his or her own mind. Find a way to implement this conviction the best you can, but knowing full well there is no universal rule.

Sleeth: How do parents and grandparents influence their loved ones in stewardship?

Blue: The key thing is: more is caught than taught. Kids are going to catch the way parents think and do things. They either reject it or they follow the example. As parents we need to model God’s ownership. Putting something in the collection plate every Sunday allows kids to catch that picture of giving. We also have the obligation to teach our kids the basics of money: bank accounts, credit cards, life insurance, mortgages, etc. It is a tragedy if kids leave home without being taught that basic life skill.

Sleeth: How does life insurance fit in the financial picture?

Blue: Several questions are important when it comes to life insurance. First, how much do I need? My dad died at age 42 without any life insurance. He was a physician. He left a widow with three children (the oldest 20 and the youngest not even 10), no income, a mortgage, and no way to pay that stuff . Eighty percent of women will be widowed and their average age would be 55 when they first became one. Not to have life insurance is in my view poor stewardship. Second, how do I pay for it? Term rates are so inexpensive in today’s competitive market that for a younger person to be uninsured is just poor planning and stewardship. I don’t believe life insurance is an investment, but it does provide coverage for the unforeseen circumstances. Finally, should one buy whole life, or cash value like products? The answer boils down to affordability. Young people typically can’t afford whole life policies. I bought a lot of whole life in college as my fraternity brother was a life insurance salesman, and it turns out that it did very well in terms of providing protection and cash value. I never tell people to cancel their whole life policy if they get one. There used to be this whole movement of “buy term life and invest the savings” – even though people never do indeed invest the difference. The important question should be what you really need and how much can you afford.

About the Author

Ron Blue is the Founding Director of Kingdom Advisors, a ministry that empowers Christian financial advisors who seek to integrate a biblical worldview into their advice and counsel. In 1979, he founded Ronald Blue & Company, the largest Christian financial planning firm in the country. He has authored eighteen books, including Master Your Money, The Complete Guide to Faith Based Family Finances, and Surviving Financial Meltdown. Ron holds a BS and an MBA from Indiana University.

Joseph C. Sleeth, Jr., is Senior Partner at Norton Rose Fulbright and heads the Private Client and Wealth Group in the Houston office. Joe is on the trustee board of HBU and serves as Chairman of the Board of Star of Hope Mission, a Christ-centered non-profit organization serving homeless men, women and children of Houston.